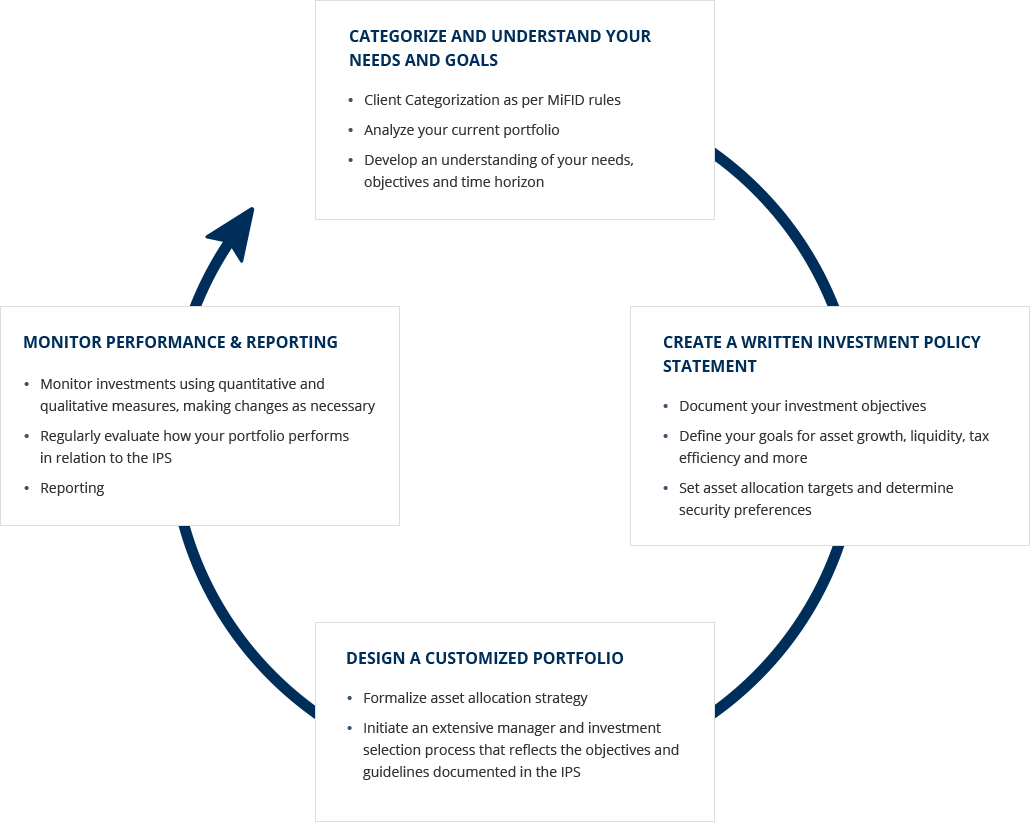

1. client categorization

Subject to MiFID rules we categorize clients as:

• Retail

• Professional or

• Eligible Counterparty

2. understand client needs and goals

• Analyze client current portfolio

• Develop an understanding of client risk profile, objectives and time horizon

3. Complete a Written Investor Profile Indicator(IPI)

• Document client investment objectives

• Define client goals for asset growth, liquidity, income and more

• Set asset allocation targets and determine security class preferences

4. Design a Customized Portfolio

• Formalize asset allocation strategy

• Initiate an extensive manager and investment selection process that reflects the objectives and guidelines documented in IPI

5. Monitor Performance

• Monitor investments using quantitative and qualitative measures, making changes as necessary

• Regularly evaluate how your portfolio performs in relation to the IPI

6. reporting

• Transparent monthly reporting

our client investment approach

Our client approach is depicted diagrammatically below: